IRC 409A OVERVIEW

Introduction to IRC 409a

The Section 409A regulation of the United States Internal Revenue Code mandates that a privately held company cannot i

Understanding Capital Structure of the Company

Introduction–

The capital structure of the company presents the combination of company’s existing debt and equity capital raised i

Valuing Stock Options under IndAS 102

Objective

This standard to specify the financial reporting by an entity when it undertakes a share-based payment transaction.

Scope

An

Understanding Incremental Borrowing Rate

The lease liability reflects the obligation to make their lease payments, and the right-of-use asset represents the right to use the underlying ass

Applicability of tax audit to various businesses and professionals

Tax Audit is applicable to various businesses & professions under Section 44AB of Income Tax Act, 1961. In order to reduce the compliance burde

Implications of COVID on Valuations for Financial Reporting

The pandemic COVID-19 outbreak and subsequent lockdown has severally affected global economies which has resulted in business disruption, volatilit

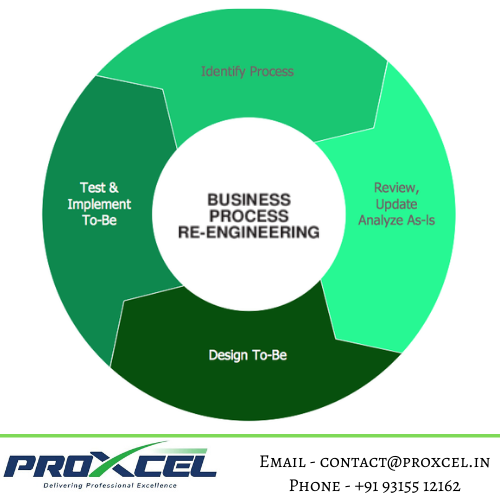

Business Process Reengineering | Let’s Improve

To achieve business objective, it is important to have a structured operational process. Investors, Board Members and Management are recognizing th

Understanding & Valuing Preference Shares

Preference Shares are issued by corporations or companies with the primary aim of generating funds. In general, in case of any exit event, preferen

Understanding & Valuing Contingent Consideration

When negotiating the purchase price of a business, Contingent Consideration is often used to bridge the price gap between what the seller would lik

STARTUP REGISTRATION

STARTUP REGISTRATION

Introduction

Startup India is an initiative of Government of India started in January 2016 to encourage the buddi

Whistle Blower Mechanism | Let’s Uncover

Whether it is in the infamous Satyam fraud case of 2009 or in the recent case of the Zee Group, ICICI or Infosys, it has been a tip from a whistle

Origination of Ind AS and its Convergence with IFRS

ProXcel is starting a new series (Valuation Vedas – I) of blog which is solely dedicated to Valuation as per Indian Accounting Standards for

Origination of Ind AS

Origination of Ind AS and its Convergence with IFRS

Over the years, there have been many changes in the Indian Accounting System. Off late, now

Indian Accounting Standard (Ind AS) 113

Indian Accounting Standard (Ind AS) 113

Ind AS 113 is a dedicated standard on Fair Value Measurement (FVM). In the previous blog, we had discus

Valuation Requirement under Income Tax

Valuation of Shares and Securities in case of fresh issuance and transfer of shares under Income Tax Act, 1961

5.1 Valuation of shares and secu

Recommendations made by GST Council on 10th November 2017

SERVICE EXPORTS FROM INDIA SCHEME (SEIS)

What is SEIS Scheme?

Served from India Scheme (‘SFIS’) has been replaced with Service Exports from India Scheme (SEIS). SEIS sh

Key Updates on Goods and Services Tax