Internal Finance Control

With the introduction of mandatory requirement of certification by auditors and board of directors for adequacy of internal financial controls in the company, the word “Internal financial control (IFC)” and “Internal Control over Financial Reporting (ICOFR)” has become wide popular.

In terms of section 143(3) (i) the Companies Act, 2013, the auditors need to certify that whether the company has adequate internal financial controls system in place and the operating effectiveness of such controls. Further Rule 8 (5) (viii) of the Companies (Accounts) Rules, 2014 requires the Board of Directors’ report of all companies to state the details in respect of adequacy of internal financial controls with reference to the financial statements.

As per 134(5)(e) of the Companies Act 2013, “Internal Financial Controls” (IFC) means

- the policies and procedures adopted by the company for ensuring the orderly and efficient conduct of its business, including adherence to company’s policies,

- the safeguarding of its assets,

- the prevention and detection of frauds and errors,

- the accuracy and completeness of the accounting records,

- and the timely preparation of reliable financial information.

As per Guidance Note issued by ICAI on Guidance Note on Audit of Internal Financial Controls Over Financial Reporting (September, 2015), “Internal Financial Controls Over Financial Reporting (ICFR)” shall mean:

“A Process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles”.

Internal Financial Control = Internal Control over Financial reporting + Operational Controls + Fraud Prevention

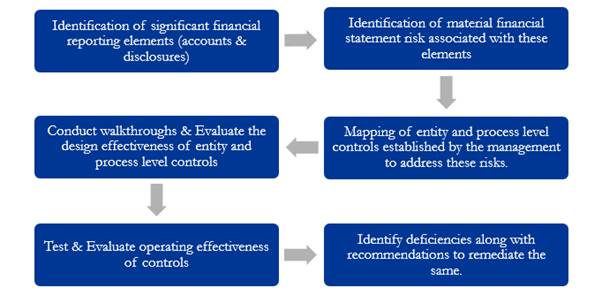

Process Road Map:-

Proxcel offers a complete solution for listed and unlisted companies in meeting their compliance relating to internal financials controls and strengthening their internal control system. Our services includes:

- Preparation of Risk Control Matrix for the various business processes

- Process Notes detailing the process flow and also the details of how the process is carried out.

- Preparation of IFC and related components of IFC such as Process owner, Nature and Type of Control, Process documentation guiding the process,

- Testing of Design and Operating effectiveness of the IFC based on a sample of transactions

- Report on deficiencies observed and action plan for remediation

Contact us

Naveen Goyal

Asst. Vice President,

Tel: +91 9315512162

Mail: naveen.goyal@proxcel.in

LinkedIn profile